Facts & Figures

Statistical Data

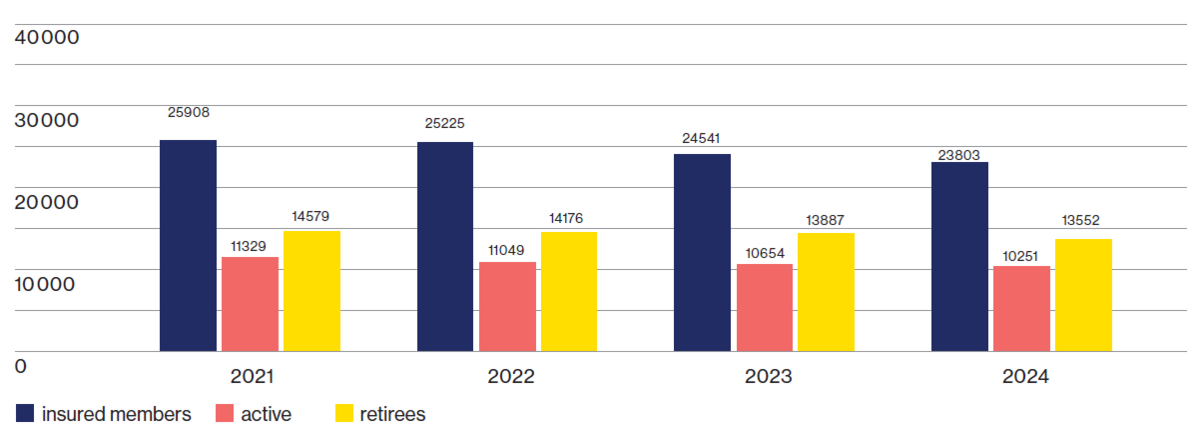

Let us start with some statistical data on Novartis Pension Fund 1 as reported in the actuarial statement:

On 31 December 2024, there were 10 251 (previous year: 10 654) actively insured members compared with 13 552 (previous year: 13 887) retirees, of whom 8 621 had reached retirement age, 281 were drawing a disability pension, and 4 186 were drawing a widow(er)’s pension. Orphans’ and children’s pensions accounted for a further 464 current pensions. The average current pension income amounted to CHF 40 092 (previous year: CHF 40 281).

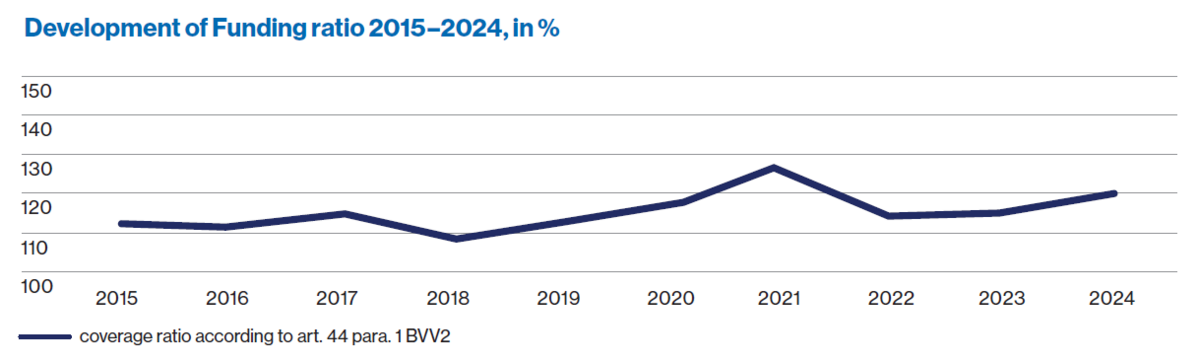

Coverage Ratio

The funding ratio is computed as the ratio of tied assets to free assets. Based on the statutory method of declaration in accordance with art. 44 para. 1 BVV 2, the funding ratio amounted to 119.4%. This means that the financial situation has been significantly strengthened compared to the previous year and that the fluctuation reserves are at their target level. Hence, the capacity of Novartis Pension Fund 1 to manage financial risk is deemed unrestricted within the framework of its strategic asset allocation. Also reflected in the funding ratio are the substantial increases of the actuarial reserves for

ensions over the past years and the provisions made for financing compensation credits in the context of the conversion rate adjustment enacted in January 2022.

With all these measures, due account was taken of the low interest rate levels that have persisted for years and the continuously rising life expectancy.

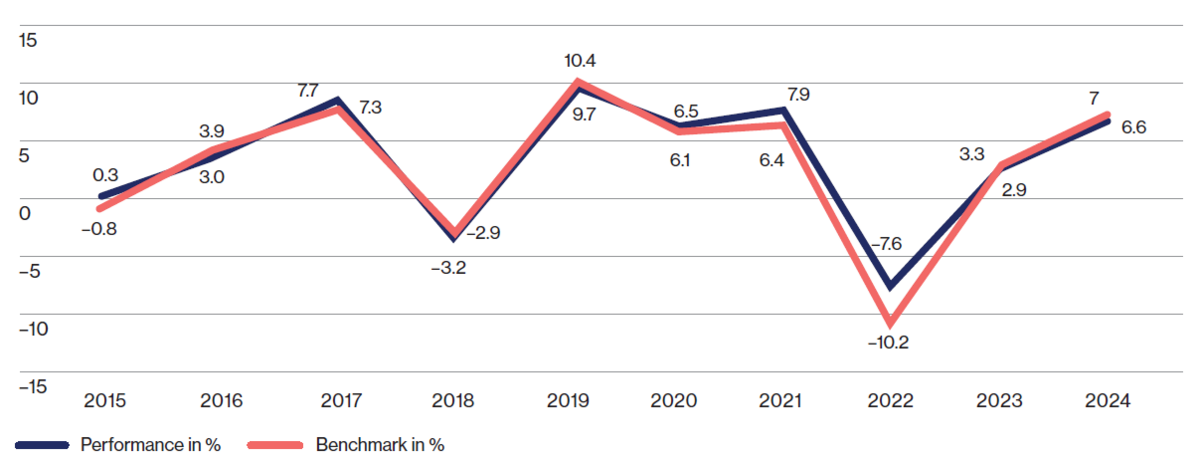

Performance

In the first quarter of the reporting year, equity markets performed well on the back of solid corporate earnings. Comparatively low local inflation allowed the Swiss National Bank (SNB) to make an unexpectedly sharp cut to its key interest rates, causing the Swiss franc to weaken against several foreign currencies. In the second quarter, encouraging inflation data in the US and the continued hype surrounding artificial intelligence provided further positive impetus for global equity markets, while lower inflation and economic data depressed US government bond yields. In the third quarter, a significant interest rate cut of 50 basis points by the US Federal Reserve and the associated easing of financial conditions to stabilize the US labor market set a positive tone for a “soft landing”. Global equities rose to a new all-time high, with the US technology and cyclical sectors leading the way. In Switzerland, the SNB cut the key interest rate by

a further 0.25 percentage points (to 1.0%).

Overall, 2024 was a strong year for investment returns as economic growth surprised on the upside and central banks began cutting interest rates. The S&P 500 index rose by 25%, the Japanese TOPIX index by 20%, the European STOXX 600 index by 10% and the MSCI Emerging Markets index by 8%. The 10-year US Treasury yield rose for the fourth consecutive year, setting the stage for weak returns on government bonds worldwide. Credit spreads tightened further and corporate bonds generated moderate returns.

In this environment, equities performed best with a gain of 15.78%, followed by real estate (+6.93%), infrastructure investments (+4.74%), foreign currencies (+4.32%), alternative investments (+2.03%) and cash and cash equivalents (+1.00%), while bonds (–1.85%) tended negatively. Overall, the performance of Pension Fund 1 amounted to 6.61%, trailing the benchmark (7.03%) by 42 basis points.

Are you interested in further information?

As a member of the Novartis Pension Funds, you may obtain the detailed Annual Report for from the Pension Fund Team: Please feel free to call

+41 61 529 28 28 or email to:thierry.beck-wissmann@novartis.com